Medicare Disadvantage

- Dan Schaefer

- Sep 18, 2025

- 5 min read

How private industry exploits a public lifeline

It may be surprising, but Medicare was not originally designed as a comprehensive health plan for seniors. When it was created in 1965, its main purpose was simple: to protect older Americans from catastrophic hospital bills that could wipe out a lifetime of savings. Because of this narrow focus, services like dental, vision, and hearing care were never included.

Over the decades, however, Medicare has evolved and expanded. It now covers outpatient doctor visits, preventive screenings, hospice care, and prescription drugs. These changes made Medicare far more valuable, but they also made it more expensive.

Consider the numbers: in 1967, Medicare cost about $4 billion. Adjusted for inflation, that’s roughly $39 billion in today’s dollars. Today, Medicare spending exceeds $1 trillion annually. That’s more than 25 times higher. Why the increase? Benefits expanded, and health care costs continue to rise.

Can Medicare survive while costs and services continue to rise? Medicare’s future depends on two trust funds. The Hospital Insurance (HI) Trust Fund, which finances inpatient hospital care (known as Medicare Part A), is the one in trouble. Current projections show that by as early as 2033, the fund’s reserves will be depleted. At that point, hospital care could only be paid for with incoming payroll taxes. At that time, payroll taxes are expected to cover about 89% of the expected costs.

That doesn’t mean Medicare will go away, but it does mean hospitals and providers could face delayed or reduced payments, and patients might be forced to make up the difference.

How do we fix it? Consider the following choices:

Cut benefits — force seniors to spend more of their retirement savings, if they have any.

Raise revenues — increase the payroll surtax on high earners, similar to the 0.9% surtax for people earning more than $200,000 in wages, enacted in 2013.

Bring down costs — one of the biggest costs is the price of prescription drugs.

On that last point, prescription drug spending is one of Medicare’s fastest-growing costs. It’s frustrating, but for decades, Medicare was legally barred from negotiating drug prices. The pharmaceutical lobby must have worked overtime to pull that one off. The 2003 Medicare Modernization Act prohibited drug price negotiation, thereby allowing pharmaceutical companies to create virtual monopolies and reap enormous profits.

The Inflation Reduction Act of 2022 began to chip away at this, allowing Medicare to negotiate prices for a limited number of high-cost drugs starting in 2026. But the scope is tiny — just 10 drugs in the first year, expanding gradually to 20 per year. Out of thousands of drugs covered by Medicare, that’s a drop in the bucket.

Meanwhile, drugmakers continue to game the system. Through practices known as “evergreening” and “product hopping,” they extend monopoly protections by making minor tweaks to existing drugs, like a new coating, a different delivery system, or a slightly altered formula. Then, older versions quietly disappear from the market, blocking generics from competing.

The result? Patients pay monopoly-level prices for drugs that should be affordable. Take insulin, for example. Insulin has been around for a century. Yale researchers estimate that some forms of insulin could be manufactured for as little as $61 per year per patient. Yet patients in the U.S. routinely pay hundreds or even thousands of dollars annually, depending on insurance coverage. Even with manufacturer discounts, the average cost is around $420 per year, seven times higher than the cost of production. The reason is that insulin is continually “evergreened,” where advanced tweaks on its formula provide an exclusive patent on its production, while older “off-patent” formulas are taken off the market.

Reforming the law to prevent evergreening and making sure off-patent drugs stay on the market as generics could save patients and Medicare hundreds of billions.

As if Medicare doesn’t already struggle enough with rising healthcare costs and prescription drug prices, it now has to deal with a competing service that has stolen its name. It’s called “Medicare Advantage,” which has little to do with Medicare and is better described as a disadvantage.

On the surface, Medicare Advantage (MA) plans look tempting. Private insurers advertise extras like dental, vision, hearing aids, and even gym memberships — benefits that Original Medicare doesn’t offer. It seems almost too good to be true … because it is.

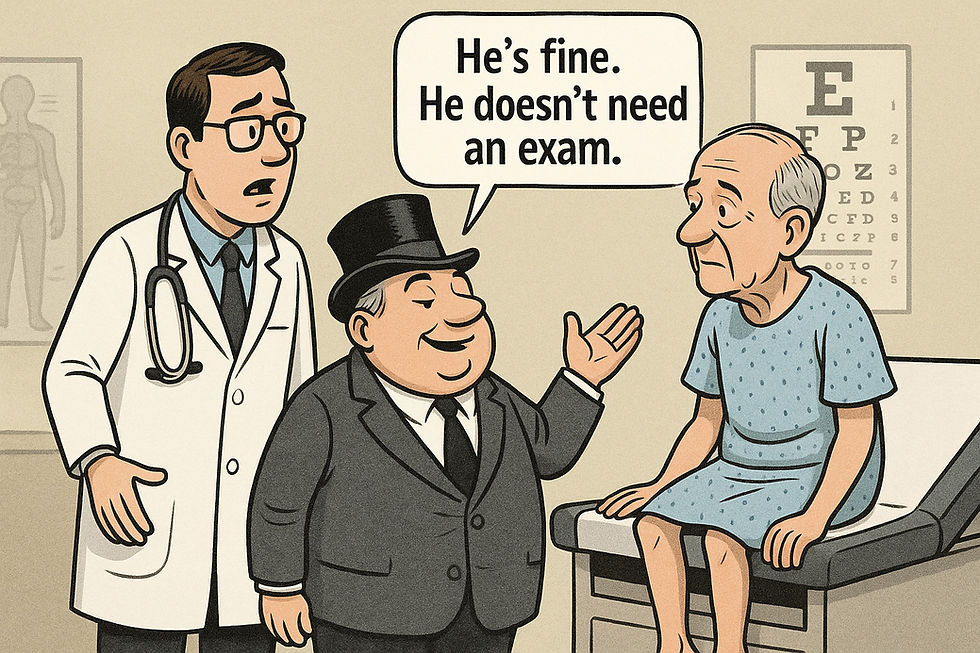

Here’s how MA plans work: insurers are paid a fixed amount per enrollee by the federal government. Insurance companies want to keep this money, so they deny approvals for medical procedures whenever possible. The more they deny, the more money they make. That means prior authorization requirements, denied claims, and narrow provider networks are built into the business model.

A senior might discover, too late, that the specialist they’ve relied on for years is now “out of network.” Or that a needed rehab stay after surgery was denied because the insurer deemed it “not medically necessary.” These are not rare exceptions; they happen often. It’s how MA insurers make their money.

Yes, Medicare Advantage plans may throw in a dental cleaning or a vision exam. But these small perks are paid for by restricting access to core medical care. Classic Medicare, by contrast, does not stand between patients and doctors with profit-driven gatekeeping. Classic Medicare prioritizes patient health above all else.

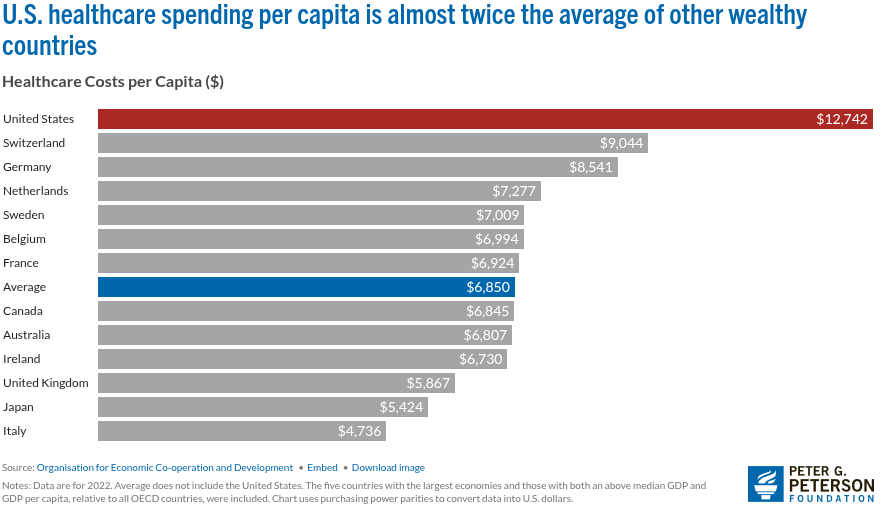

How might Medicare expand in the future? Support is growing for extending Medicare—or something similar—to cover all Americans. It’s called “Medicare for All.” It aims to provide basic medical coverage for everyone, regardless of age or income. Although this may seem like a big change for healthcare, it would align America with most other industrialized nations that see healthcare as a right, not just a privilege for the wealthy. Currently, the U.S. spends well over $12,000 per person each year on medical coverage, which is the highest among industrialized countries and nearly twice what Canada spends.

Those who fight for Medicare for All need to be cautious, however. The lesson from Medicare Advantage is that private companies will always try to sneak into public programs to make profits at patients’ expense. They will hollow out the system and reap profits for themselves. If Medicare for All can avoid this fate, it may well provide healthcare for every American while significantly reducing our medical costs.

The bottom line: Medicare was created to protect seniors from financial ruin. It has evolved into a lifeline for tens of millions of Americans. But it faces threats — from insolvency, from predatory drug pricing, and from private insurers who exploit its brand while undermining its mission.

A possible path forward includes the following:

Allow Medicare to negotiate all drug prices.

End practices that block generic drug competition.

Strengthen the Hospital Insurance Trust Fund (Part A) with fair contributions from those most able to pay.

Expand Medicare’s core benefits to include dental, vision, and hearing — basic needs that should never have been excluded.

Medicare was created to serve people, not corporations. With determination, we can strengthen it, expand it, and ensure it remains a true public lifeline — not another profit center for industry.

Originally published in the Frontline Progressive, September 19, 2025

Comments